The government's every effort is in sync with the powerful vision of Vocal for Local and Local for Global, which has reached the pinnacle of success. Indians are realizing the strength and potential of India, and every Indian is thinking of doing something new and big.

The same loud Indian voice, enthusiasm, and passion resonate from the Red Fort on January 26, 2026, making global powers stand in respect of India. India's soil has a fragrance, and Indians have a sacred thinking that develops the spirit of "Vasudhaiva Kutumbakam".

We Indians take pride in being Indian, our chest swells with pride because India's Constitution is such that it enhances our respect and we give it the same respect as a religious scripture.

That's why the glory of the tricolor is our life, the Constitution is our soul, and India is our devotion, giving us the highest respect as a world leader.

Happy 77th Republic Day!

Share your thoughts and Republic Day posts on Talkfever, a homegrown social media platform, with over 1 crore global community. Share more and more to make it a platform for every Indian.

Big News -

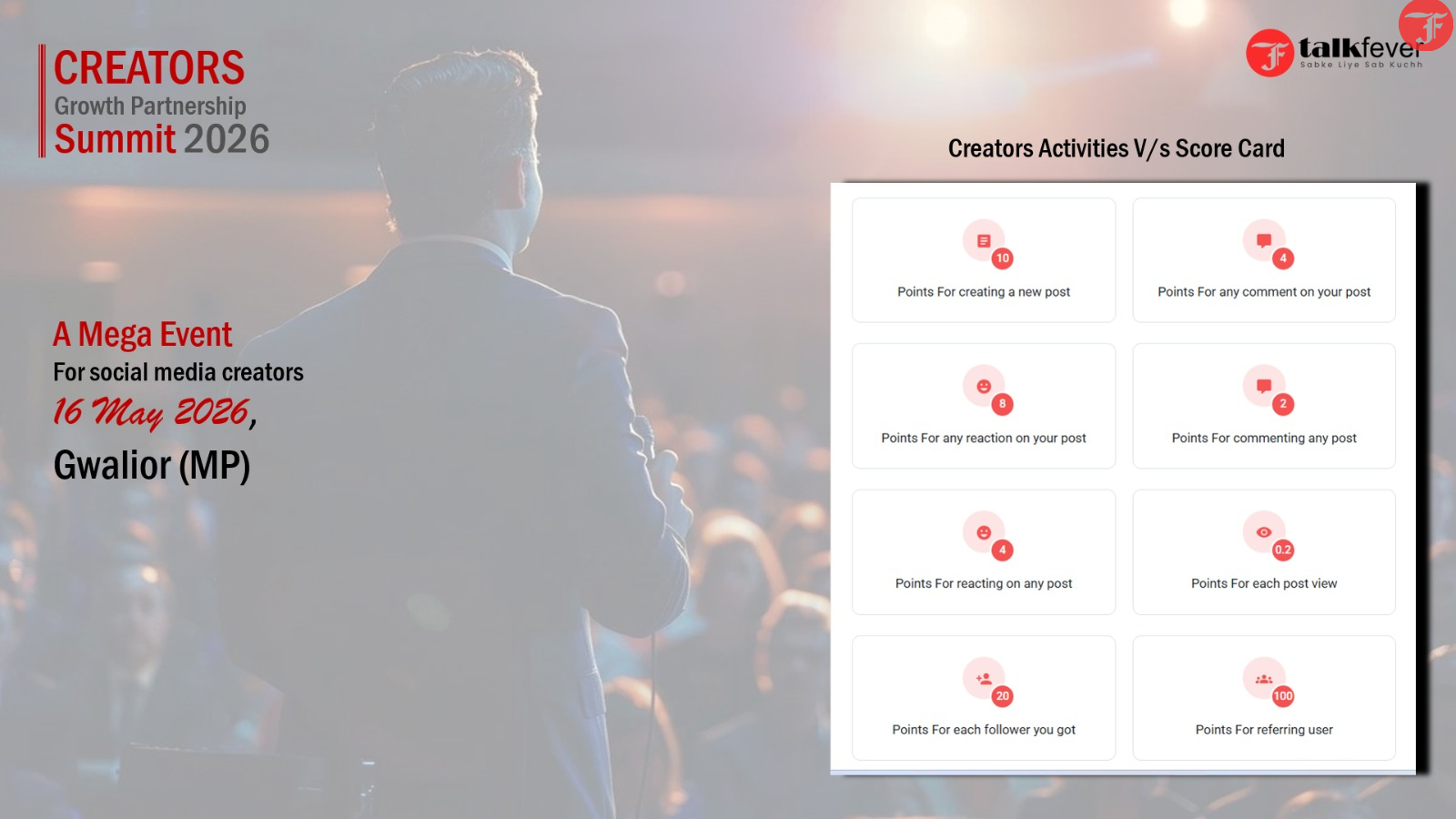

Talkfever's Creator Growth Partnership Award 2026 is live! A ranking system based on creative posts, social network growth, and growth marketing capacity. Top 1000 creators get a chance to win big at Talkfever's Creator Summit.

The government's every effort is in sync with the powerful vision of Vocal for Local and Local for Global, which has reached the pinnacle of success. Indians are realizing the strength and potential of India, and every Indian is thinking of doing something new and big.

The same loud Indian voice, enthusiasm, and passion resonate from the Red Fort on January 26, 2026, making global powers stand in respect of India. India's soil has a fragrance, and Indians have a sacred thinking that develops the spirit of "Vasudhaiva Kutumbakam".

We Indians take pride in being Indian, our chest swells with pride because India's Constitution is such that it enhances our respect and we give it the same respect as a religious scripture.

That's why the glory of the tricolor is our life, the Constitution is our soul, and India is our devotion, giving us the highest respect as a world leader.

Happy 77th Republic Day!

Share your thoughts and Republic Day posts on Talkfever, a homegrown social media platform, with over 1 crore global community. Share more and more to make it a platform for every Indian.

Big News -

Talkfever's Creator Growth Partnership Award 2026 is live! A ranking system based on creative posts, social network growth, and growth marketing capacity. Top 1000 creators get a chance to win big at Talkfever's Creator Summit.

·3K Visualizações

·1 Compartilhamentos

·0 Anterior