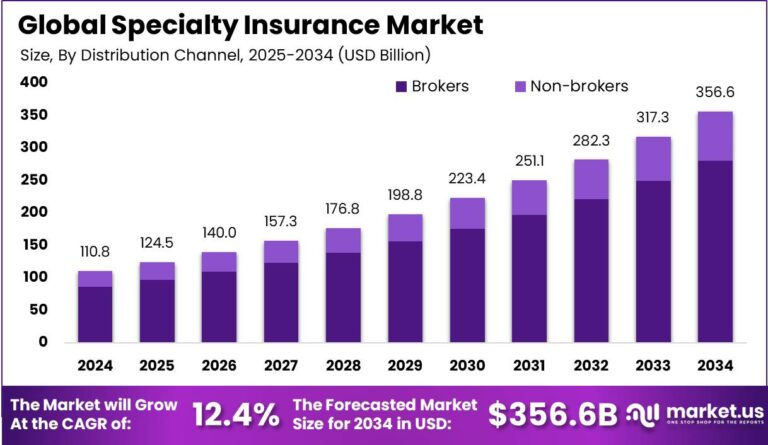

Specialty Insurance Market size is expected to be worth around USD 356.6 Billion

The Global Specialty Insurance Market size is expected to be worth around USD 356.6 Billion By 2034, from USD 110.8 Billion in 2024, growing at a CAGR of 12.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the Specialty Insurance sector with a 35.2% market share and revenues of approximately $39 billion. The U.S. Specialty Insurance Market was valued at $31.2 billion and is projected to grow at a CAGR of 10.2%.

Read more - https://market.us/report/specialty-insurance-market/

The specialty insurance market addresses risk exposures that standard insurance policies often exclude or cover inadequately. These involve situations where the asset, operation or liability is unusual, complex, high-value or emerging in nature. Because of their unique character, these risks require tailored underwriting: bespoke policy wording, specialist expertise, enhanced data analytics and a distribution chain that can navigate complexity. With the global risk environment evolving — thanks to digital disruption, climate change, extended supply-chains, global trade, and rising high-net-worth assets — demand for these specialized coverages is increasing. At the same time, the specialty space poses heightened challenges: underwriting is more complex, loss events can be large or correlated, historic data may be insufficient, and competition and capacity cycles are intense. Insurers and intermediaries operating in this sector must balance growth with disciplined risk-management, invest in technology and specialist talent, and remain agile to capture evolving opportunities.

Key points

-

The market serves non-standard risk exposures: those which are outside mainstream policy forms, involve unique assets (fine art, collectibles, exotic vehicles), specialized operations (aviation, marine, transport), or emerging liabilities (cyber, political risk, credit).

-

Segmentation exists across risk types (for example marine/aviation/transport, political risk/credit, professional liability, art/collectibles, emerging exposures), by distribution channel (specialist brokers dominate, but digital/direct channels are growing) and by end-user (large enterprises with complex profiles, as well as high-net-worth individuals).

-

Growth drivers include increasing complexity of business and personal risk environments, new forms of exposure (digital, supply-chain, climate), rising values of specialised assets, and the ability of technology and analytics to make previously hard-to-insure risks more manageable.

-

Technological and operational evolution in underwriting, data-analytics, artificial intelligence, IoT and automation are enabling insurers to underwrite these niche risks more precisely and cost-effectively, thereby expanding the accessible premium base.

-

Despite the growth appeal, the specialty insurance space brings elevated risk: limited historical data for some exposures, accumulation risk (many exposures concentrated in similar spaces or geographies), underwriting cycle volatility (hard vs soft markets), capacity constraints, and the need for specialist talent and infrastructure.

-

Geographically, mature insurance markets currently contribute significant volume because of established infrastructure, high asset values and wealth, while emerging markets show faster growth potential as industry, trade and wealth expand.

-

Successful players in this segment tend to combine deep domain expertise in one or more niche lines, strong specialist distribution networks (particularly via brokers), flexible product design and underwriting, and advanced analytic/technological capability. The ability to differentiate on service, speed, customisation and risk-management rather than simply offering lower price often matters more in specialty lines.

-

Looking ahead, the outlook remains favourable: as emerging risks (for example cyber, renewable energy/clean-tech, intangible asset exposures, advanced supply-chain risks) proliferate and as underwriting technology matures, the specialty insurance market is likely to continue out-pacing many standard insurance segments. At the same time, maintaining underwriting discipline, managing exposure concentration, and investing in specialist capability will be critical for sustainable performance.