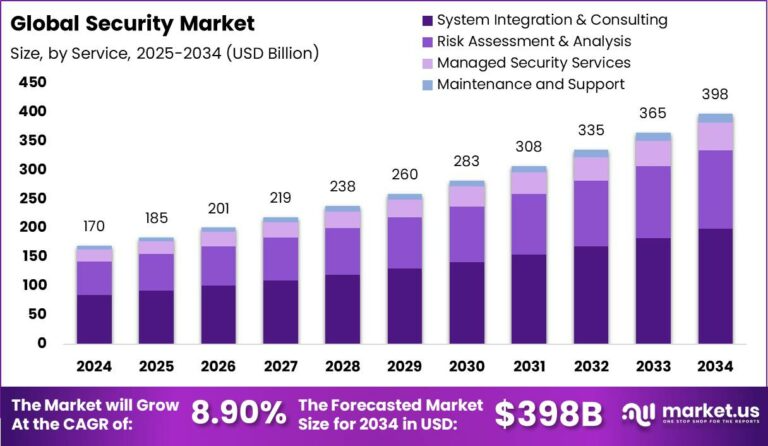

Security Market size is expected to be worth around USD 398 Billion

The Global Security Market size is expected to be worth around USD 398 Billion By 2034, from USD 169.55 Billion in 2024, growing at a CAGR of 8.90% during the forecast period from 2025 to 2034. North America maintained a dominant position in the global security market in 2024, holding over 33.6% of the market with revenues amounting to USD 56.9 billion.

Read more - https://market.us/report/security-market/

The Global Security Market encompasses all systems, technologies, and services designed to safeguard physical assets, digital data, and human life. It covers areas such as physical security, cybersecurity, access control, surveillance, identity management, and cloud-based protection. With growing digital transformation, the convergence between physical and cyber security has become crucial for businesses, governments, and individuals across the world.

Key Points:

-

The market includes physical, digital, and hybrid security systems.

-

Integration of AI, IoT, and analytics drives smart and adaptive security solutions.

-

Demand is rising due to increasing cyberattacks, terrorism, and data theft.

-

Organizations seek unified platforms to reduce complexity and improve visibility.

The market structure is divided across various solution categories and industries. Physical security includes video surveillance, fire safety, and access control, while cybersecurity covers network defense, endpoint protection, encryption, and identity management. The growing hybrid work culture has expanded the need for cloud-based and mobile security systems, creating new business opportunities for service providers.

Key Points:

-

Major categories: Hardware, Software, and Managed Services.

-

End-user sectors: Government, BFSI, Healthcare, Manufacturing, Retail, and Energy.

-

Deployment models: On-premises, Cloud, and Hybrid setups.

-

Regional demand varies, with North America and Asia-Pacific leading growth.

The major growth drivers of the Global Security Market include the expansion of digital infrastructure, increased regulatory mandates, and the rising sophistication of both physical and cyber threats. With rapid urbanization and smart city projects, surveillance and access control technologies are becoming central to national and corporate strategies. Similarly, the increasing reliance on cloud computing has elevated the need for robust digital defenses.

Key Points:

-

Rising security concerns across smart cities and industries.

-

Growth in cloud adoption leading to new cybersecurity investments.

-

Expansion of IoT and connected devices increasing attack surfaces.

-

Government initiatives and compliance policies boosting spending.

Despite strong growth, the market faces challenges related to cost, complexity, and interoperability. Many organizations struggle to integrate legacy systems with modern platforms. Additionally, the shortage of skilled security professionals and high implementation costs limit adoption in small and mid-sized enterprises. Privacy concerns and evolving regulatory frameworks also create compliance hurdles.

Key Points:

-

Integration of old and new technologies remains difficult.

-

High deployment and maintenance costs for advanced systems.

-

Lack of trained personnel and operational expertise.

-

Data privacy and regulatory conflicts pose legal challenges.