Embedded Security Market size is growing at a CAGR of 10%

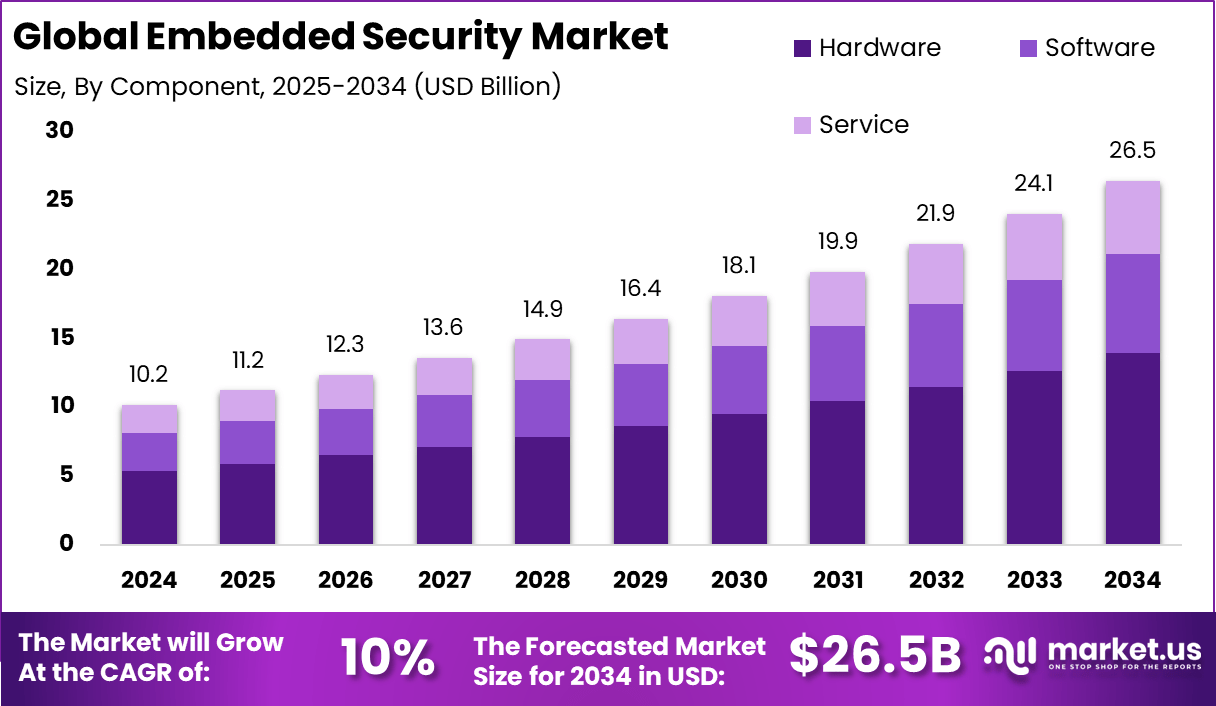

The Global Embedded Security Market size is expected to be worth around USD 26.5 Billion By 2034, from USD 10.2 billion in 2024, growing at a CAGR of 10% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.2% share, holding USD 4.1 Billion revenue.

Read more - https://market.us/report/global-embedded-security-market/

The Embedded Security Market refers to the industry focused on integrating security solutions directly into hardware and software systems to protect devices from cyber threats. It encompasses technologies like encryption, secure boot, and authentication mechanisms embedded in devices such as IoT gadgets, automotive systems, and smart cards. This market is critical as it safeguards sensitive data and ensures the integrity of connected devices in an increasingly digital world. Its growth is driven by the need for robust protection against evolving cyber risks, making it essential for industries like healthcare, automotive, and consumer electronics.

The Embedded Security Market, in a broader sense, represents the ecosystem of solutions designed to secure embedded systems, which are specialized computing systems performing dedicated functions within larger devices. It includes hardware like secure microcontrollers and software like firmware updates, addressing vulnerabilities in connected environments. The market is expanding rapidly due to the proliferation of smart devices and the rising sophistication of cyberattacks. It plays a pivotal role in ensuring data privacy and system reliability across sectors, fostering trust in digital transformation.

Top driving factors for the Embedded Security Market include the surge in cyber threats targeting connected devices and the growing adoption of IoT across industries. Stringent regulatory mandates for data protection, especially in automotive and healthcare, push companies to integrate robust security. The rise of digital transformation and smart infrastructure also fuels demand for embedded security solutions. Additionally, advancements in AI and machine learning enhance threat detection, driving market growth further.

The Global Embedded Security Market size is expected to be worth around USD 26.5 Billion By 2034, from USD 10.2 billion in 2024, growing at a CAGR of 10% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.2% share, holding USD 4.1 Billion revenue.

Read more - https://market.us/report/global-embedded-security-market/

The Embedded Security Market refers to the industry focused on integrating security solutions directly into hardware and software systems to protect devices from cyber threats. It encompasses technologies like encryption, secure boot, and authentication mechanisms embedded in devices such as IoT gadgets, automotive systems, and smart cards. This market is critical as it safeguards sensitive data and ensures the integrity of connected devices in an increasingly digital world. Its growth is driven by the need for robust protection against evolving cyber risks, making it essential for industries like healthcare, automotive, and consumer electronics.

The Embedded Security Market, in a broader sense, represents the ecosystem of solutions designed to secure embedded systems, which are specialized computing systems performing dedicated functions within larger devices. It includes hardware like secure microcontrollers and software like firmware updates, addressing vulnerabilities in connected environments. The market is expanding rapidly due to the proliferation of smart devices and the rising sophistication of cyberattacks. It plays a pivotal role in ensuring data privacy and system reliability across sectors, fostering trust in digital transformation.

Top driving factors for the Embedded Security Market include the surge in cyber threats targeting connected devices and the growing adoption of IoT across industries. Stringent regulatory mandates for data protection, especially in automotive and healthcare, push companies to integrate robust security. The rise of digital transformation and smart infrastructure also fuels demand for embedded security solutions. Additionally, advancements in AI and machine learning enhance threat detection, driving market growth further.

Embedded Security Market size is growing at a CAGR of 10%

The Global Embedded Security Market size is expected to be worth around USD 26.5 Billion By 2034, from USD 10.2 billion in 2024, growing at a CAGR of 10% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.2% share, holding USD 4.1 Billion revenue.

Read more - https://market.us/report/global-embedded-security-market/

The Embedded Security Market refers to the industry focused on integrating security solutions directly into hardware and software systems to protect devices from cyber threats. It encompasses technologies like encryption, secure boot, and authentication mechanisms embedded in devices such as IoT gadgets, automotive systems, and smart cards. This market is critical as it safeguards sensitive data and ensures the integrity of connected devices in an increasingly digital world. Its growth is driven by the need for robust protection against evolving cyber risks, making it essential for industries like healthcare, automotive, and consumer electronics.

The Embedded Security Market, in a broader sense, represents the ecosystem of solutions designed to secure embedded systems, which are specialized computing systems performing dedicated functions within larger devices. It includes hardware like secure microcontrollers and software like firmware updates, addressing vulnerabilities in connected environments. The market is expanding rapidly due to the proliferation of smart devices and the rising sophistication of cyberattacks. It plays a pivotal role in ensuring data privacy and system reliability across sectors, fostering trust in digital transformation.

Top driving factors for the Embedded Security Market include the surge in cyber threats targeting connected devices and the growing adoption of IoT across industries. Stringent regulatory mandates for data protection, especially in automotive and healthcare, push companies to integrate robust security. The rise of digital transformation and smart infrastructure also fuels demand for embedded security solutions. Additionally, advancements in AI and machine learning enhance threat detection, driving market growth further.

·2KB Vue

·0 Aperçu