Global Tire Retreading Market Share, Growth Rate (CAGR), Historical Data and Forecast 2030

Tire Retreading Market Expected to Reach USD 7.23 Billion by 2030, Driven by Sustainability and Cost Efficiency

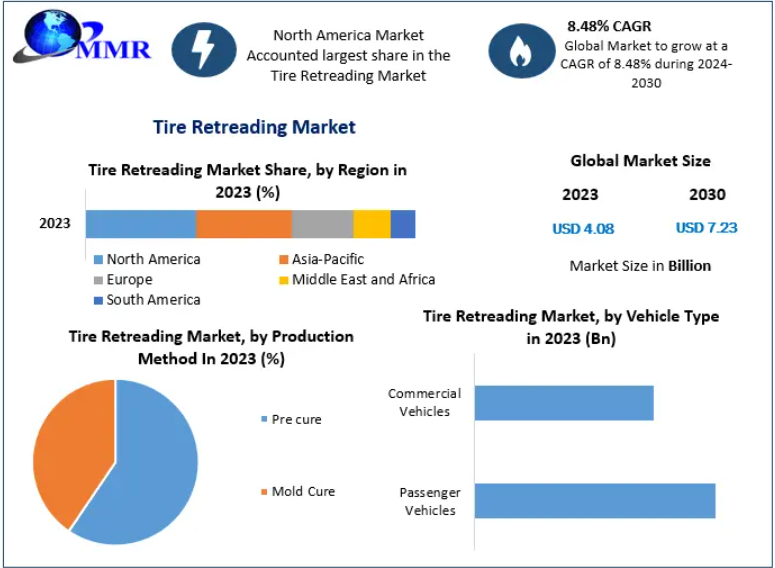

The Global Tire Retreading Market is witnessing strong growth and is projected to reach USD 7.23 billion by 2030, growing from USD 4.08 billion in 2023, at a CAGR of 8.48% during the forecast period. Increasing awareness about sustainability, coupled with the cost advantages of retreaded tires, is significantly boosting market demand. Companies and fleet operators are showing a strong preference for retreaded tires as an eco-friendly and economically viable solution to traditional tire replacement.

Market Definition and Estimation

Tire retreading refers to the process of re-manufacturing used tires by replacing the worn tread with a new one. This not only extends the life of the tire but also ensures safety, performance, and significant cost savings compared to purchasing new tires. The process involves inspecting the used tire casing for damages, repairing any defects, and attaching a new tread either through pre-cure or mold-cure methods.

The global market valuation stood at USD 4.08 billion in 2023 and is projected to expand robustly through 2030, highlighting the growing trend towards sustainable practices across the automotive and transportation sectors.

Ask for Sample to Know US Tariff Impacts on Tire Retreading Market @ Sample Link:https://www.maximizemarketresearch.com/request-sample/81491/

Market Growth Drivers and Opportunities

1. Emphasis on Sustainability:

Environmental concerns regarding tire waste and raw material consumption are prompting businesses and individuals to opt for retreaded tires. Retreading significantly reduces landfill contributions and carbon footprints, aligning with the global sustainability agenda.

2. Cost Savings for Fleet Operators:

Tire retreading is substantially cheaper than purchasing new tires, typically offering savings of 30% to 50%. For logistics companies and fleet operators, this translates into reduced operational costs without compromising on safety and performance.

3. Advancements in Technology:

Continuous improvements in inspection techniques, tread materials, and curing technologies have enhanced the quality and durability of retreaded tires. Modern retreading techniques ensure that retreaded tires perform comparably to new ones, making them an increasingly viable option for heavy-duty applications.

4. Growing Demand from Commercial Vehicle Segment:

The booming logistics and transportation industries globally are fueling the demand for commercial vehicles, which in turn is accelerating the adoption of tire retreading solutions.

5. Regulatory Support:

Government regulations in favor of sustainable practices and resource conservation have encouraged industries to incorporate tire retreading as a primary strategy for waste reduction.

Segmentation Analysis

The tire retreading market is segmented based on production method and vehicle type, with each segment witnessing different growth patterns based on demand dynamics.

By Production Method

-

Pre-Cure Retreading:

In this method, pre-vulcanized tread rubber is applied to the prepared casing. It is the most commonly used method due to its flexibility in offering different tread patterns and cost efficiency. Pre-cure retreading is widely preferred in regions focusing on low-cost, high-volume tire retreading. -

Mold-Cure Retreading:

Mold-cure involves placing the prepared casing into a mold where the new tread is directly formed and cured onto the tire. Although it is a slightly more expensive process, it offers better visual aesthetics and is often chosen for high-performance requirements where enhanced bonding strength is essential.

By Vehicle Type

-

Passenger Vehicles:

While the retreading of tires for passenger vehicles remains relatively smaller compared to commercial segments, growing awareness of sustainability and the increasing cost of tires are slowly driving adoption in this category. -

Commercial Vehicles:

Commercial vehicles dominate the global retreading market. The extensive use of buses, trucks, and trailers in logistics and transportation sectors necessitates cost-effective and durable tire solutions, making retreading a highly attractive option for fleet managers.

Country-Level Analysis

United States

The U.S. is a leading contributor to the global tire retreading market, accounting for a significant share due to its mature transportation industry and the widespread adoption of sustainable practices by fleet operators. In 2024, the U.S. tire retreading market is estimated at approximately USD 1.74 billion, with a steady growth trajectory over the next few years. Government incentives for green transportation practices and growing cost pressures in logistics industries continue to drive the demand for retreaded tires across commercial fleets.

Germany

Germany represents a vital market for tire retreading in Europe, with an estimated value of around USD 328 million in 2024. The country’s strong automotive sector, coupled with stringent environmental regulations and the increasing need for circular economy practices, is fueling the growth of the tire retreading industry. Fleet operators in Germany are increasingly adopting retreaded tires to lower operational costs while meeting strict sustainability standards.

To know about the Research Methodology :-https://www.maximizemarketresearch.com/request-sample/81491/

Competitive Landscape and Commutator Analysis

The tire retreading market is highly competitive, featuring several established global players that emphasize technological innovation, strategic partnerships, and product quality to maintain their market leadership.

-

Bridgestone Corporation is known for offering advanced tire retreading services that match the safety and performance standards of new tires. The company continues to invest in expanding its retreading networks globally.

-

Michelin Group emphasizes environmental responsibility and retreading quality, providing solutions aimed at heavy-duty vehicles and fleet operators focused on sustainability.

-

The Goodyear Tire & Rubber Company maintains a strong presence in the North American retreading market, offering a range of retread options suited for various commercial applications.

-

Marangoni S.p.A, an Italian-based player, focuses heavily on technological advancements, offering high-performance tread rubber compounds and retreading machinery.

-

Kraiburg Austria GmbH & Co. KG specializes in retreading materials and has established a strong presence in Europe, emphasizing product quality and service innovation.

New entrants and regional players are also making strategic moves through collaborations and the adoption of advanced materials to tap into growing market opportunities. Competition is expected to intensify over the forecast period as more players target emerging economies and high-growth regions.

Conclusion

The global tire retreading market is poised for sustained growth over the next decade, driven by the rising need for sustainable, economical alternatives in the automotive industry. The strong cost benefits, coupled with increasing environmental consciousness and supportive regulatory frameworks, are steering both consumers and businesses toward tire retreading solutions.

As advancements in technology continue to enhance the performance and safety of retreaded tires, the market is likely to see expanded adoption across new vehicle categories and geographies. Companies that invest in quality enhancement, customer education, and strategic partnerships will be best positioned to capitalize on the opportunities emerging within this dynamic and evolving market.