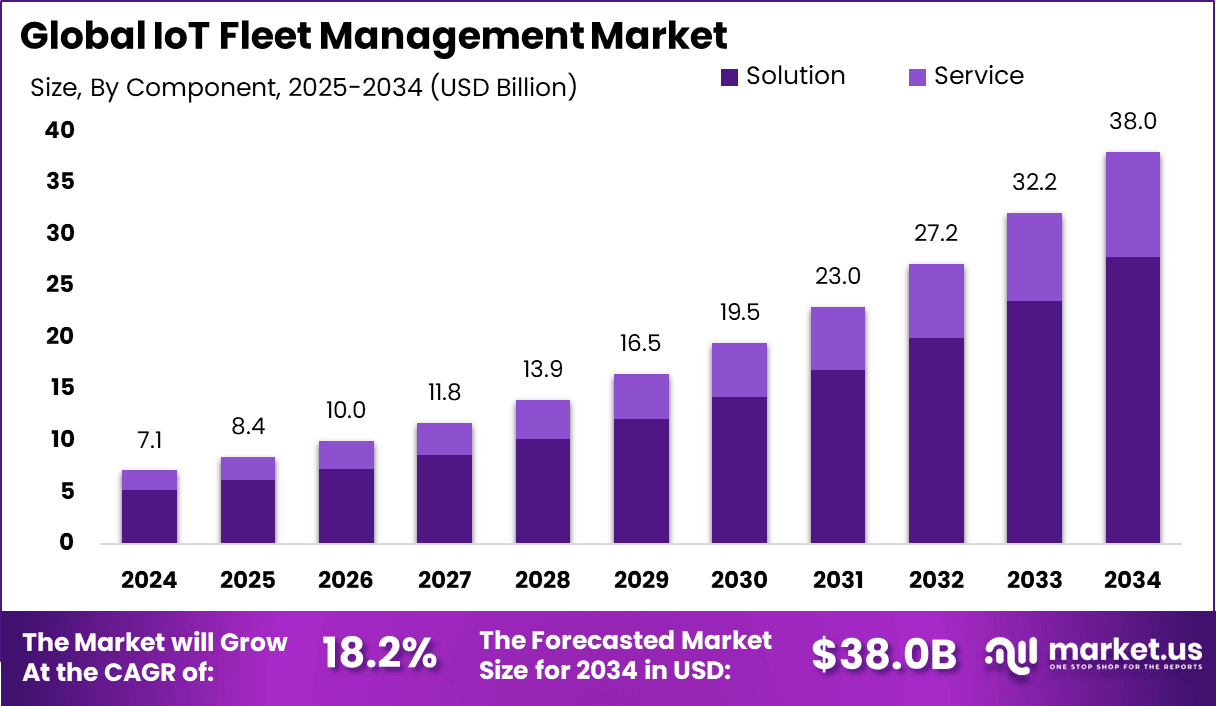

IoT Fleet Management Market size is growing at a CAGR of 18.2%

The IoT Fleet Management Market size is expected to be worth around USD 38.0 Billion By 2034, from USD 7.1 billion in 2024, growing at a CAGR of 18.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.1% share, holding USD 2.7 Billion revenue.

Read more - https://market.us/report/global-iot-fleet-management-market/

Executive summary

IoT fleet management combines in-vehicle sensors, connectivity, edge gateways, cloud platforms and analytics to provide real-time visibility, operational control, safety monitoring and decision automation for vehicle fleets. Over the next 5–10 years the market is expected to grow rapidly as e-commerce, electrification, stricter safety/emissions rules and demand for cost efficiencies push fleets to adopt connected solutions. Solutions are evolving from simple location/telemetry to advanced video telematics, predictive maintenance, EV charge orchestration and platform ecosystems that tie into supply-chain and insurance workflows.

Market size & forecast (approximate, indicative)

-

Estimated market size (global, hardware + software + services): ~USD 6–12 billion (current baseline year estimate).

-

Forecast path: continued double-digit growth driven by recurring SaaS subscriptions, managed services and rising value of analytics. Representative compound annual growth rate (CAGR) expectations: about 12%–20% over the next 5–7 years.

-

By the end of the decade, the market could reach a low-to-mid two-digit billion USD range depending on EV penetration and adoption velocity of advanced telematics and video services.

Market definition & scope

This report treats IoT fleet management as the full stack required to operate and optimize mobile assets:

-

Hardware: GPS/OBD/ELD devices, dash cams, sensors (temperature, load, tire pressure), gateways.

-

Connectivity: cellular (M2M), LPWAN (LTE-M/NB-IoT), satellite for remote assets.

-

Software & analytics: cloud platforms, route optimization, driver behaviour, predictive maintenance, EV/charge management, dashboards, APIs.

-

Services: integration, installation, managed operations, data analytics services, professional services.

Key market drivers

-

Cost reduction & ROI: measurable savings from route optimization, fuel reduction, reduced idle time, lower insurance premiums, and preventive maintenance.

-

Last-mile & logistics growth: explosive growth in parcel delivery and on-demand services creates demand for tighter SLA adherence and visibility.

-

Regulation & compliance: electronic logging, driver safety standards, emissions reporting push fleets to collect structured data.

-

Electrification & new vehicle types: EV fleets need battery telematics, charging orchestration and new maintenance models.

-

Analytics & AI maturity: predictive and prescriptive analytics turn telemetry into decisions, improving uptime and utilization.